Introduction:

Table of Contents

An option is a type of financial derivative. It gives the buyer of that option the privilege of buying or selling some underlying asset (like a stock or an index) at a pre-determined price, called the ‘strike price’, within a specified date, called the ‘expiry date’. There are mainly two types of options: call option and put option.

Today option trading are an integral part of the financial market, providing investors the flexibility of hedging their portfolio and potential profit, often used by retail and institutional traders and investors. Option trading actively takes place in India through the F&O (Futures & Options) segment on the National Stock Exchange (NSE). In recent time, option trading has become very popular almost a fashion to trade both an easy and complex option strategies irrespective of their expertise, knowledge on option, experience, and capital. Let’s find the details of option to get a clear understanding of what an option is and how it functions.

What is Call Option?

We already know that an option buyer has the rights to buy and seller has obligation to sell an underlying asset. To get clarity on Call Option, we need to understand the call option from buyers and sellers’ perspective.

A trader buys a call option when he expects that price of the underlying asset will increase within the expiry date. On the other hand, seller (also called ‘writer’) believes that price of underlying will fall or stay below the strike price. While buying a call option, the buyer has to pay some money for his rights called option premium and seller receives that premium as an income against the obligation he undertakes.

Let clarify this with a practical example. A trader buys a Nifty 50 call option with a strike price of ₹22,500, expiring at the end of the month. The premium for this option is ₹200 per lot. If, by expiry, Nifty 50 trades at ₹23,000, the trader can exercise the option (close the trade) and make a profit of ₹500 (₹23,000 – ₹22,500), minus the premium paid. Minus the premium he paid at the time of buying.

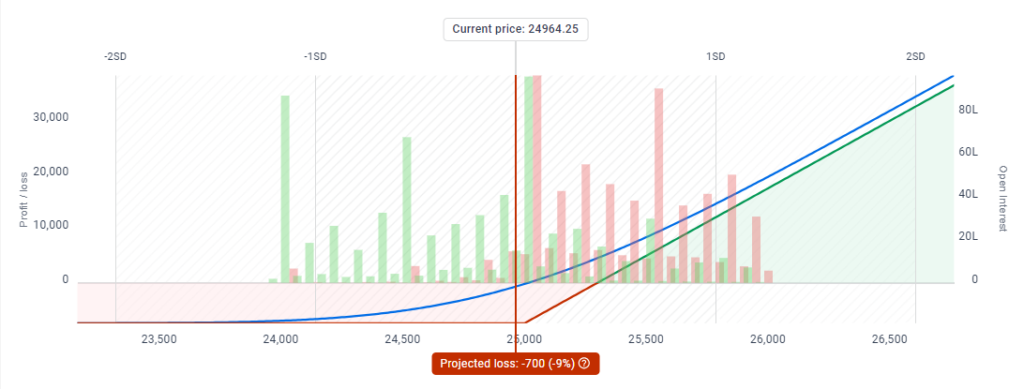

Source: https://web.sensibull.com/

What is Put Option?

Again, to get clarity on Put Option, we need to understand the put option from buyers and sellers’ perspective.

A trader buys a put option when he expects that price of the underlying asset will decrease within the expiry date. On the other hand, seller (also called ‘writer’) believes that price of underlying will further rise or stay above the strike price. While buying a put option, the buyer has to pay some money for his rights called option premium and the seller receives that premium as an income against the obligation he undertakes.

Let clarify this with a practical example. A trader buys a Reliance put option with a strike price of ₹2,500 by paying a premium of ₹50. If Reliance’s price drops to ₹2,400 by the expiry, the trader can sell the stock at ₹2,500, although the current market price is ₹2,400, making a profit from the price difference. Minus the premium he paid at the time of buying.

Source: https://web.sensibull.com/

Key Terminology used in Option Trading

Underlying Asset:

The asset on which the option is based (that is it is called derivatives). In the Indian market, the underlying could be individual stocks like Reliance, TCS, or indices like Nifty 50, Bank Nifty.

Strike Price:

It is the pre-defined price at which an option is bought by call and put buyer. on the other hand, an option seller will sell it on that price. The strike price determines whether the option is in profit or not when compared to current price of the underlying. This leads to the concept of in-the-money (ITM), out-of-the-money (OTM), and at-the-money (ATM) option. These terms define the relationship between the strike price of an option and the current market price.

ITM (In-the-Money):

- Call Option: A call option is considered ‘In-the-Money’, when the underlying price of the asset is above the strike price.

- Put Option: A put option is considered ‘In-the-Money’, when the underlying price is below the strike price.

For e.g. Suppose Reliance is currently trading at ₹2,700 and you bought a call option with a strike price of ₹2,600, your option will be called ITM by 100 points (2,700 – 2,600). So, it can be exercised profitably.

OTM (Out-of-the-Money):

- Call Option: A call option is considered ‘Out-of-the-Money’, when the underlying price of the asset is below the strike price.

- Put Option: A put option is considered ‘Out-of-the-Money’ when the underlying price of the asset is above the strike price.

For e.g. Suppose Reliance is currently trading at ₹2,500 and you have a call option with a strike price of ₹2,600, your option will be called by OTM by 100 points. So, by exercising this trader will make a loss of 100 points.

ATM (At-the-Money):

An option is considered ‘At-the-Money’, when the underlying price of the asset is equal to the strike price.

For e.g. Suppose Reliance is currently trading at ₹2,600 and you bought a call or put option with a strike price of ₹2,600, then it will be considered ATM.

Important: Whether an option is ITM, OTM, or ATM can help a trader to guess the likelihood of the option being profitable before the expiry. ITM options have intrinsic value, while OTM options have time value.

Premium:

While buying an option both call and put, the buyer pays a certain price for the rights he acquired. That price is called premium of that option. This price is non-refundable in nature.

Intrinsic Value:

The difference between the current price of the underlying asset and the strike price. ITM options will always have some intrinsic value, while OTM options have no intrinsic value.

Extrinsic Value:

It is also called ‘Time Value’. When the premium is more than the intrinsic value, The addition price of the option’s premium that is known as extrinsic value.

Expiry Date:

It is a pre-defined date that shows the validity of the option contract on which the option must be exercised, or expires as worthless.

Lot Size:

Unlike shares of a company, options are bought and sold in a bundle of shares. The numbers of shares in the bundle is pre-determined by the exchange. That pre-defined quantity is called a Lot.

For e.g., in the Indian market (NSE), the lot size of Nifty is 25 now at the time of writing this article. Market regulator (SEBI for India) can change the lot size time to time.

American vs. European Style Options:

In Indian market, options follow the European style of execution, which means that options can be exercised only on the expiry date, while American options can be exercised any time before expiration.

How the Option Trading Works in the Stock Market

Indian market allows option trading in both stocks (e.g. SBI, ITC) as well as indices (e.g. Nifty, Bank Nifty). The strike prices, expiry dates, and lot sizes are pre-determined by the exchange & regulators. In India, options are expired on the last Thursday of the month. In addition to monthly expiry, we also have weekly expiries. However, weekly expiries are only available for indices like Nifty 50 and Bank Nifty.

Let us understand through an example how option trading works. Suppose, on the basis of your analysis you are convinced that Reliance Industries (RIL) stock is likely to rise further in the near future. To take the advantage of this price rise, you bought a call option on RIL with a strike price of ₹2,500 with an expiration date of one month.

- When the stock price of Reliance increases to ₹2,600 on the expiration date, you can exercise your call option, means you can buy Reliance shares at the rate of ₹2,500, & subsequently sell them in the market price for ₹2,600 thus making a good profit of ₹100 per lot.

- When the price of Reliance stock falls below the strike price of ₹2,500 on the expiration date, then your call option will expire worthless. You will lose the premium paid for buying it. However, loss is limited to premium paid.

Key Objectives of Option Trading

1. Portfolio Hedging

Options were developed primarily to mitigate the risk. So portfolio managers use it as a hedging tool to protect portfolios from downside risks. For e.g., an investor holding a large quantity of Reliance stock. An easy way to protect the value of the portfolio against the down side risk is to buy put options as insurance. If stock price of Reliance falls, the value of the put options will rise, which will mitigate the losses incurred in the stocks. For e.g. You have 500 shares of Tata Motors that you acquired @₹600 each, and your analysis predicts that price can fall from this level in short term. You can buy ATM put option of Tata Motors and pay some premium as an insurance. Suppose the stock price really went down to ₹550, your put option will increase in value, that will give some relief to your stock portfolio.

2. Speculation

Traders often use option to speculate on price movements without owning the underlying asset. As you know buying an option of a stock is way cheaper than buying equivalent quantity of that stocks. Options are bought and sold in lots as explained earlier. Because of low cost of options, compared to the actual underlying stocks, traders tend to speculate the direction of the market and try to profit from price movements with much lower capital that gives then a very good return-on-investment. At the same time risk is also limited to the extent of premium. Example: A trader believes that Infosys, currently trading at ₹1,500, will rise significantly before its quarterly results. Instead of buying 100 shares for ₹1,50,000, the trader buys a call option for a premium of ₹50, paying ₹5,000 only. If the price rises to ₹1,600, the option will become profitable.

3. Leverage

Option trading provide leverage, meaning traders can control a large amount of the underlying asset with a relatively small investment. This amplifies potential returns, though it also increases the risk of loss.

4. Income Generation

Selling options, or “writing” options, can be a way to generate income. Traders sell options to collect premiums, hoping the option will expire worthless. This strategy, however, involves significant risk if the market moves against the seller. Example: A trader sells a Nifty 50 call option with a strike price of ₹23,800, believing the index will not surpass that level before expiry. The trader collects a premium upfront. If Nifty stays below ₹23,800, the option expires worthless, and the trader keeps the premium as profit.

Common Risks Involved in Option Trading

Although, trading in option can generate a very high return, but it also has some risks. Those must be mitigated or considered before jump in to the option trading. Most common and obvious risks are mentioned here.

- Risk that affects the most is known as ‘Time Decay’ or ‘Theta Decay’. Option price reduces as the time passes. In other words, as the expiry comes nearer, the value of option decreases. This is the nature of option and is called ‘Time Decay’. However, a trader can take advantage of this phenomena. Time decay is the number one enemy for an option buyer, but a friend for a seller. Option price will decrease as time pass even if the price of the underlying stock increases in the expected direction.

- Option sellers have potentially unlimited loss when the trade goes against them. Although option buyers have limited risk (to the extent of premium paid), sellers will have unlimited potential losses in case the trade goes wrong.

- Option liquidity, some stock option may suffer from low liquidity, meaning there might be fewer buyers and sellers in the market, leading to wider bid-ask spreads and making it more difficult to enter or exit a position at favorable prices.

Some Popular Option Strategies

Option is a strategic tool that can be used in many ways depending on the market situation. There are many strategies in option trading, some strategies are easy to understand and implement. A strategy can have a single leg like buying a call or put. Generally, option strategies are made with two, three and four legs that involves both buying and selling. Some of the most commonly used strategies are listed below:

Buying a naked Call

This is obviously a bullish strategy. When a trader expects that price of the underlying asset will increase then this would the most simple and easy strategy to deploy.

Buying a naked Put

This is obviously a bearish strategy. When a trader expects that price of the underlying asset will decrease then this would the most simple and easy strategy to deploy.

Covered Call

This strategy is a combination of stocks and option. It can be done when the trader has certain stocks in his demat account and wants to take advantage of that. To deploy this strategy trader needs to sell an out of the money call option for the underlying stock that trader already own. This will bring some income from the premium received.

Straddle

Straddle strategy is used when a trader expects significant price movement but not sure about the direction. It requires buying both a call and a put option at the same strike price and expiry, generally ATM strikes are used for this.

Strangle

It is a combination of a long call and a long put with different strike prices and with the same expiration date. Generally used to bet on a large price movement but without specifying the direction.

Iron Condor

It is an advanced strategy that requires four option legs (two calls and two puts) with different strike prices, but with same expiry. It aims to profit from low volatility in the market. Generally used when market is moving sideways.

All about Option Greeks

Greeks are the risk metric and is used to analyse potential risks in the option strategy. There are five primary Greeks that affect the price of an option. These can be used to do what-if analysis to check the potential outcome of an option strategy.

Primary Greeks used in Option Trading:

- Delta: Delta is the risk metric that tells us how much an option price will increase or decrease for every ₹1 change in the price of the underlying.

- Gamma: It measures the rate of change of delta with increase or decrease for every ₹1 change in the price of the underlying.

- Theta: Measures the decay in the time value (extrinsic value) of an option with every passing day till the expiry.

- Vega: An important risk metric that measures the impact of an option price with 1% changes in volatility.

- Rho: Not a significant factor as it measures the impact of an option price against the changes in interest rates. Interest rates are not frequently changed.

Indian Regulatory Framework

Option trading is regulated by the Securities and Exchange Board of India (SEBI). Some regulations that impact every trader are mentioned below:

- Margin Requirements: A trader must have enough money in his account to meet the margin requirement while selling option.

- Position Limits: There is a limit on the number of contracts that a trader can hold.

- Disclosure Requirements: Large positions must be disclosed to the exchanges.

Conclusion

For a beginner, option trading can be quite complex due to multiple factors that affects the option price and strategy. However, with clear understanding of these factors anyone can take advantage of options trading.

With time and experience one can manage the risk, and make informed decisions. So, it is always better to start with a solid understanding of the concept to take advantage of the power of option. Indian market is continuously evolving and growing in volume. Option trading will surely play an important role in the financial market.

Author: Debasish Biswas.

An independent Retail Trader & Investor

for the last 18 years in Indian Stock Market.

1 thought on “A Beginners Guide to Option Trading”