Table of Contents

Introduction:

Are you looking for an option trading strategy that can generate consistent income? If so, you’re in the right place. Let’s explore one of the simplest yet very effective option trading strategy known as ‘OTM Ratio Spread’. This option trading strategy can be an excellent starting point for those new to options, as well as for experienced traders.

Strategy Highlights

- Generate above average return on investment

- Consistent income generation

- Ease of managing the risk effectively

- Probability of profit more than 75%

- Works in bullish, bearish and neutral market

Understanding the OTM Ratio Spread

To understand clearly let’s break down the name of this option trading strategy in two parts. Number one “OTM” meaning Out of the Money. This means the strikes we choose for this strategy are OTM strikes.

Number two “Ratio Spread’. By spread we mean buy and sell two different strikes of the same expiry. Ratio means that quantity or number of lots for buy and sell are not equal but in some ratio. For example, 1:2 or 2:3 or any other ratio. In this option trading strategy, we sell more quantity than buy making it a credit spread. In other words, we receive more premium by selling one or more strikes than paying premium on buying strikes.

Type of OTM Ratio Spread

There are three possible types of ratio spreads as described below.

Using Call Option (Bearish Direction):

In this case you buy an OTM Call and sell further OTM Call in more quantity. This will form a bearish payoff chart with no loss on the downside no matter how much the underlying stock/index falls. However, there will be an unlimited loss on the upside. Although breakeven on the upside will be far away from the ATM or spot price. So, this can be a strategy for a bearish market.

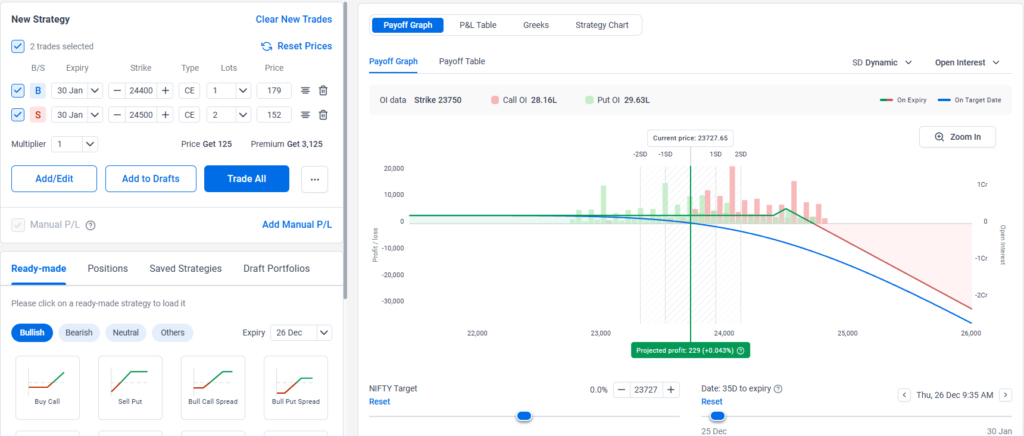

A simple ‘Call Ratio Credit Spread’ can be implemented using two OTM legs as shown in picture-1. In this case one lot is bought and two lots are sold resulting in net credit. So here the ratio is 1:2

Picture-1

Another possible variation with more net credit is shown in picture-2. In this case the ratio is 1:3 where one lot is bought and three lots are sold, however sold legs are of different strikes. Since sold legs are broken into two parts, the actual ratio is 1:1:2

Picture-2

Using Put Option (Bullish Direction):

In this case you buy an OTM Put and sell further OTM Put in more quantity. This will form a bullish payoff chart with no loss on the upside no matter how much the underlying stock/index rises. However, there will be an unlimited loss on the downside. Although breakeven on the downside will be far away from the ATM or spot price. So, this can be a strategy for a bullish market.

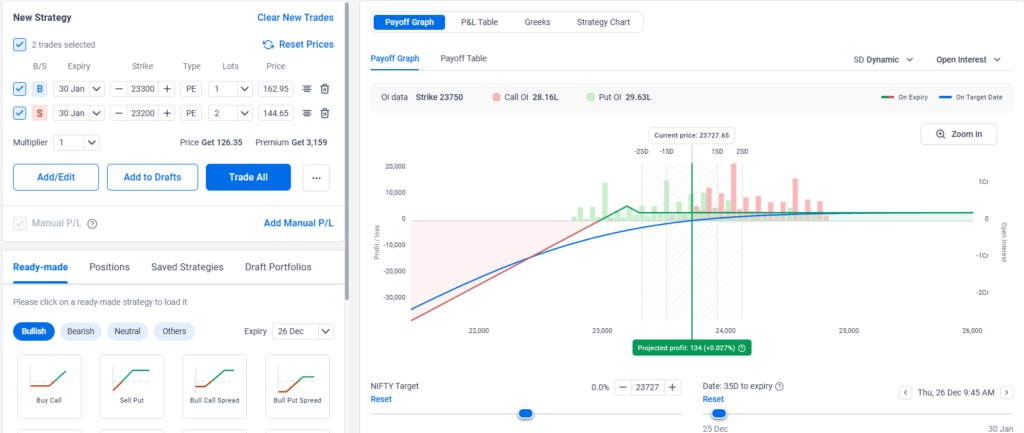

A simple ‘Put Ratio Credit Spread’ can be implemented using two OTM legs as shown in picture-3. In this case one lot is bought and two lots are sold resulting in net credit. So here the ratio is 1:2

Picture-3

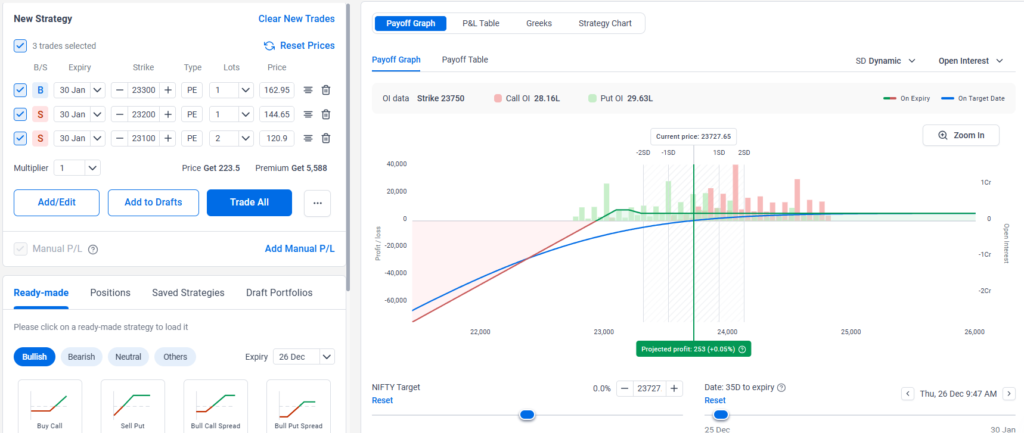

Another possible variation with more net credit is shown in picture-4. In this case the ratio is 1:3 where one lot is bought and three lots are sold, however sold legs are of different strikes. Since sold legs are broken into two parts, the actual ratio is 1:1:2

Picture-4

Using both Call and Put Option (Direction Neutral):

In this case you buy an OTM Call and Put and sell further OTM Call and Put in more quantity. This will form a range-bound payoff chart with unlimited loss on both up and downside.

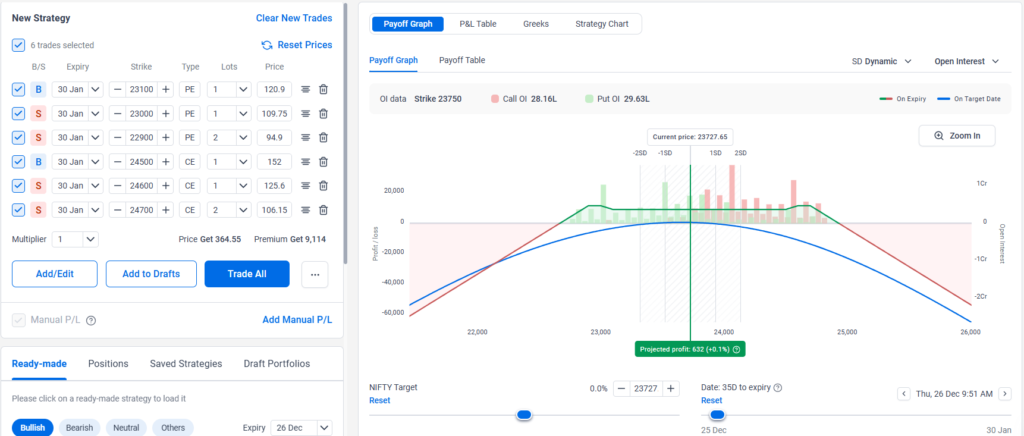

In this case when the underlying stock/index rises or falls too much on one side, the strategy will make loss. Although breakeven on either side can be very wide. This strategy can be called as “Double OTM Ratio Spread”. So, this can be a strategy for a range-bound market. Refer the picture-5.

Picture-5

Double OTM Ratio Spread is the combination of both Call and Put credit spread with a ratio of 1:1:2 on both sides. In this case net credit is higher and break-even is also higher along with probability of profit.

Key Points for this Option Trading Strategy

Implementation Criteria

- Analyze and assess the broad direction of the underlying stock/index. If there is a bullish bias then implement the Put Ratio Spread with 1:1:2 ratio. On the other hand, when there is a bearish bias then implement the Call Ratio Spread with 1:1:2 ratio. In case of non-directional market situation, double OTM ratio spread can be implemented.

- As this is a net credit strategy, higher IV (implied Volatility) situation is more suitable for profitability. Higher IV will lead to higher premium even on the OTM strikes. You can use IVP (implied volatility percentile) to check if the IV of that underlying is suitable for the strategy or not. As a benchmark consider IVP around 40 and above, higher the better.

- Check the liquidity and volume of the OTM strikes. Bid-Ask spread must be suitable for executing the trade. Lower the bid-ask spread better it is.

- As a benchmark, consider the Delta of the buy leg around 25 both for Call and Put. It must be below 30 Delta. First sell leg can be two strikes OTM from the Buy leg and second sell leg should be two strikes further OTM as shown in picture 2 and 4.

Analyzing Pay-Off Diagram

Once the strategy payoff chart is created following all the implementation criteria, it is time to evaluate if this trade is aligned with your trading objective or goal. Consider each of the seven questions below for a ‘Three Sixty Degree Analysis’ before taking any trading decision. If the answer is yes for most of the questions, then execute the trade.

- Is your directional analysis matching with the payoff chart?

Note: Check the Breakeven points on either side if you have taken the double OTM ratio spread. Based on the volatility of the underlying, the breakeven points can differ. For Nifty Index 5% breakeven from spot price for next two to three weeks may be a good whereas for another volatile stock the breakeven distance may be 8% for the same period.

- Is the POP (probability of profit) more than 75%?

Note: To be on the safe side, consider a minimum probability of profit as 75%. Of course, higher the POP better it is. Although higher POP will reduce the realized profit. A professional trader always prefers a higher POP over the extra profit amount. Trader must decide and take the decision. As a best practice you can use 80% to get out of the trade without any adjustments most of the times.

- Is minimum profit potential matching the profit target?

Note: In this strategy minimum profit potential is the flat line in the pay-off chart. Most of the cases a trader will exit from the trade when the profit is near to that level. So, you need to decide if that profit amount is good enough to take the risk. Because beyond breakeven points without adjustments you have unlimited loss.

- Is margin requirement vs profit target meet the return on investment expectation?

Note: For any trade return on investment (ROI) is the key criteria, this option trading strategy is not an exception. Different underlying will have different margin requirement for executing the trade. Hence you must check the ROI. Anything above 2% ROI for monthly expiry can be considered a rational expectation.

- Is the DTE (days-to-expiry) enough for adjustments and premium?

Note: Days to expiry plays a crucial role in any option trading strategy. With lower DTE it is difficult to adjust any strategy as the premium reduces as the time elapse. This is a strategy that uses OTM strikes hence lower DTE will reduce the ROI. As a best practice, use minimum 21 days to expiry. However, 30 to 45 days can be very effective when underlying asset is an Index like Nifty.

- Is your breakeven point beyond 2 Standard Deviation level?

Note: It is observed from statistical analysis that around 95% of the values are within 2 standard deviations of the mean. Assume the spot price of the underlying as mean and different closing prices throughout the DTE as random values. So, having the breakeven price beyond the 2 SD level means that there is a 95% chance that the price at expiry will remain within the breakeven points statistically. This will give confidence to the trader that minimum potential profit can be achieved.

- Is your breakeven point beyond the highest Open Interest strikes?

Note: Open interest (OI) is buildup in various strikes and generally considered as level of support and resistance. Because open interest is often seen from seller’s perspective. So, highest OI at a higher strike price is considered as a strong resistance level. Similarly, highest OI at a lower strike price can be considered as a strong support level.

However, OI is dynamic and need to monitor as support and resistance levels tend to break all the time. In general price has a tendency to respect a support or resistance level at first. If the breakeven points are beyond those highest OI strikes on either side than trader is confident that price may remain within the breakeven points giving the expected profit.

Impact of Greeks – Delta, Theta & Vega

Three Sixty Degree Analysis for an option trading strategy is incomplete without analysis of option ‘Greeks’ specially Delta, Theta and Vega. As this strategy is a combination of multiple buy and sell legs hence, we need to consider the positional Greeks. This means the summation of all Delta, Theta and Vega values of all the legs.

As this option trading strategy is a net credit strategy, the Theta value will be always positive and Vega will be negative. In other words, time value is always in favor but an increase in implied volatility (IV) will impact the profit negatively. However, towards the expiry IV will always reduce that would bring profit to this strategy. When the positional Delta has a positive value then rise in underlying price will increase profit and fall in price will decrease profit. On the other hand, a negative value of positional Delta will increase profit when price falls and decrease profit when price rises.

Journaling the Trade

All professional traders maintain a journal of their trading activities in some form or formats. It is essential to keep track of the trade taken and to determine when and on what situation some action is required for this trade. It can be a corrective adjustment, an adjustment to book partial profit or provisioning for additional profit even exiting from the trade itself.

In this strategy keeping the following information is paramount. This information will help to manage the trade effectively.

- Price of the underlying at the time of initiating the trade and ATM strike

- Strikes of highest open interest for both Call and Put

- IVP at the time of initiating the trade

- Initial 1 SD and 2 SD levels

- Initial probability of profit

- Initial Breakeven points

Trade Management

1. Monitor and Manage the Trade

Since it is not an intraday trade and all the legs of this strategy are OTM strikes, there is no need for constant monitoring and any immediate action. Higher the breakeven level lesser the need for monitoring and any appropriate action.

2. When to initiate Adjustment

Need for adjustment will arise on the following situation.

- For Call Ratio Spread, spot price moved significantly on the upside threatening the upside breakeven point. Adjustment should be initiated when spot price moves beyond initial 1 SD level or around the Call buy leg. Also new situation of the market suggests a further upside movement of prices.

- For Put Ratio Spread, spot price moved significantly on the downside threatening the downside breakeven point. Adjustment should be initiated when spot price moves beyond initial 1 SD levels or around the Put buy leg. Also new situation of the market suggests a further downside movement of prices.

- For Double Ratio Spread, spot price moved significantly on either upside or downside threatening any of the breakeven point. Adjustment should be initiated when spot price moves beyond initial 1 SD levels or around the buy leg. Also new situation of the market suggests a continuation of movement of prices on the same direction.

3. Type of Adjustments

There are a number of adjustments possible in this option trading strategy. We will focus on two easy to implement and most effective adjustments. Let’s take each of the three strategies separately.

Call Ratio Spread (Bearish Trade):

In this trade risk is only on the upside beyond the breakeven point. There are no downside risks at all refer the pay-off chart, picture 1 and 2.

Adjustment #1

Exit from the extra sell leg to make it a simple Call Debit Spread. Refer the picture 1 where one lot Call is bought (strike 24400) and two lots Call is sold (strike 24500) that forms a 1:2 ratio spread. Once the extra call sell is reduced it is converted to a call debit spread with limited risk and limited profit.

Refer the picture 2 where two additional call sold at strike 24600. This leg can be exited to make it a Call Debit Spread.

Note: As the price is moving on the upside, a fresh Put Ratio Spread can be implemented to make this trade more profitable. However, that will need additional capital.

Adjustment #2

Add an extra call buy leg above the existing call sell leg (strike 24500) to convert it to a Call Butterfly Spread. Refer the picture 1 where one lot extra call can be bought at strike 24600 to make it a butterfly spread with 1:2:1 ratio.

Note: As the price is moving on the upside, a fresh Put Ratio Spread or even a simple Put Credit Spread with double or triple lot size can be implemented to make this trade more profitable. However, that will need additional capital.

Put Ratio Spread (Bullish Trade):

In this trade risk is only on the downside beyond the breakeven point. There are no upside risks at all refer the pay-off chart, picture 3 and 4.

Adjustment #1

Exit from the extra sell leg to make it a simple Put Debit Spread. Refer the picture 3 where one lot Put is bought (strike 23300) and two lots Put is sold (strike 23200) that forms a 1:2 ratio spread. Once the extra Put sell is reduced it is converted to a put debit spread with limited risk and limited profit.

Refer the picture 4 where two additional Put sold at strike 23100. This leg can be exited to make it a Put Debit Spread.

Note: As the price is moving on the downside, a fresh Call Ratio Spread can be implemented to make this trade more profitable. However, that will need additional capital.

Adjustment #2

Add an extra put buy leg below the existing put sell leg (strike 23200) to convert it to a Put Butterfly Spread. Refer the picture 3 where one lot extra put can be bought at strike 23100 to make it a butterfly spread with 1:2:1 ratio.

Note: As the price is moving on the downside, a fresh Call Ratio Spread or even a simple Call Credit Spread with double or triple lot size can be implemented to make this trade more profitable. However, that will need additional capital.

Double OTM Ratio Spread (Direction Neutral):

In this trade risk is on the both side beyond the breakeven points on each side. There is unlimited risks on either side refer the pay-off chart, picture 5.

- Call Side Adjustment

When price is moved extremely on the upside to threaten the Call side profit. Remove the extra Call sell leg (strike 24700), refer the picture 5. This will protect the upside risk completely.

In this scenario Put side will be in profit. You can take the profit and create a fresh Put Ratio Spread on higher strikes. This will add further credit to the strategy making the trade more profitable.

- Put Side Adjustment

When price is moved extremely on the downside to threaten the Put side profit. Remove the extra Put sell leg (strike 22900), refer the picture 5. This will protect the downside risk completely.

In this scenario Call side will be in profit. You can take the profit and create a fresh Call Ratio Spread on lower strikes. This will add further credit to the strategy making the trade more profitable.

4. Exit Strategy

Profit or loss is realized only when you exit the trade. Hence exiting a trade plays a vital role in the game of trading. Hence the decision to exit a trade must be predefined by rules and not by emotions. Three simple rules can be applied to exit from this strategy.

- When the predefined minimum ROI is achieved, for e.g. 2%

- A predefined percentage of maximum profit of the strategy is achieved, for e.g. 60%

- A predefined max loss amount is hit for this strategy

Conclusion

Each of the option trading strategy has its own risk-reward profile. Hence each strategy is unique in terms of entry condition, management and exit. A trader must consider all the key points explained in this article. As this strategy has unlimited loss potential a trader must have clear understanding and expertise on execution, management and exiting from the trade.

Well explained strategy with clear adjustment aaand exit rules. A very practical strategy